No products in the cart.

In today’s fast-paced business environment, efficiency is paramount. While many businesses meticulously track their visible expenses, they often overlook the hidden costs lurking within their Point of Sale (POS) systems. These unseen drains can significantly impact profitability, hindering growth and operational effectiveness. Here’s a breakdown of 7 hidden costs you might be losing:

1. Lost Revenue from Slow Transactions

In today’s fast-paced environment, customers expect swift and efficient service. Slow transaction processing times, whether at a physical point-of-sale (POS) or online, directly contribute to longer queues and increased customer frustration. This frustration stems from the perceived waste of valuable time, leading to a negative customer experience. Research consistently indicates that a significant percentage of customers, particularly those with time constraints, will abandon their purchases entirely if faced with excessive wait times. This phenomenon is amplified during peak hours, when transaction volume is highest, and even a few seconds of delay can create a bottleneck.

The Impact: The consequences of slow transactions extend far beyond mere customer annoyance. Reduced customer turnover is a primary concern, as frustrated individuals are less likely to complete their intended purchases and may choose to patronize competitors in the future. This loss of immediate sales translates directly to lost revenue. Furthermore, negative customer reviews, both online and through word-of-mouth, can significantly damage a business’s reputation. In the digital age, where online reviews heavily influence consumer decisions, this reputational damage can have long-lasting effects on customer acquisition and retention. The cumulative impact of lost sales and damaged reputation can severely hinder a business’s profitability and growth potential.

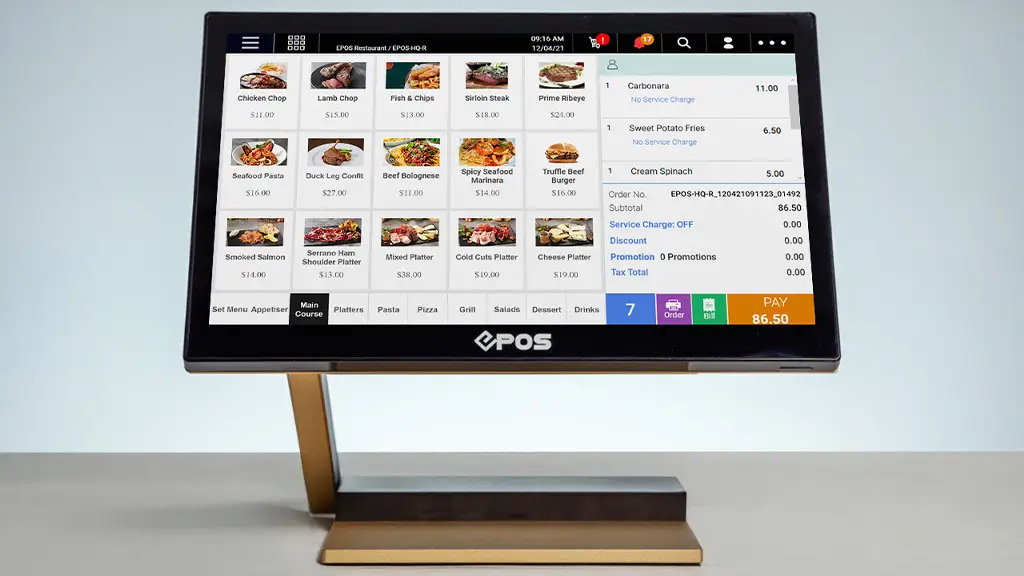

The Solution: To mitigate the detrimental effects of slow transactions, businesses must prioritize investment in efficient POS systems. Implementing a POS system with rapid processing capabilities, capable of handling high transaction volumes without significant delays, is crucial. This includes optimizing hardware and software components to minimize processing times and ensure seamless data transfer. Additionally, utilizing mobile POS (mPOS) options can expedite transactions by enabling staff to process payments from anywhere within the business premises. This flexibility reduces bottlenecks at traditional checkout counters and allows for faster service during peak hours. By prioritizing speed and efficiency, businesses can significantly reduce customer frustration, improve customer satisfaction, and ultimately, protect their revenue streams.

2. Inaccurate Inventory Management

A significant hurdle faced by many businesses, particularly in retail and manufacturing, is inaccurate inventory management. This problem stems from two primary sources. Firstly, the absence of real-time inventory tracking leads to a disconnect between physical stock and recorded data. This lack of synchronization often results in either stockouts, where products are unavailable when needed, or overstocking, where excess inventory accumulates. Secondly, relying on manual inventory counts introduces a high risk of human error. These errors can arise from miscounting, mislabeling, or simply overlooking items, further exacerbating the discrepancies in inventory records.

The Impact: The consequences of inaccurate inventory management are substantial and detrimental to a business’s bottom line. Stockouts directly translate to lost sales, as customers are unable to purchase desired products, potentially driving them to competitors. Overstocking, on the other hand, leads to increased storage costs, as businesses must allocate resources to house excess inventory. Furthermore, perishable or time-sensitive products may become obsolete or expire, resulting in significant product waste and financial losses.

The Solution: To mitigate the challenges associated with inaccurate inventory management, businesses must adopt modern and efficient strategies. Implementing a Point of Sale (POS) system equipped with automated inventory tracking capabilities is crucial. This system provides real-time updates on stock levels, enabling businesses to monitor inventory movement and identify potential stockouts or overstocking situations promptly. Additionally, the POS system should be configured to generate low-stock alerts, notifying managers when inventory levels fall below predefined thresholds. Utilizing data analytics to forecast demand is another essential step. By analyzing historical sales data, seasonal trends, and market fluctuations, businesses can accurately predict future demand and optimize stock levels accordingly. This data-driven approach minimizes the risk of stockouts and overstocking, leading to improved inventory efficiency and reduced operational costs.

3. Increased Labor Costs

Several factors contribute to elevated labor expenses. Firstly, reliance on inefficient POS systems necessitates increased manual labor. Tasks such as data entry, inventory tracking, and generating sales reports become time-consuming and require dedicated staff. Secondly, poor scheduling practices can lead to either overstaffing during slow periods or understaffing during peak hours. Overstaffing results in unnecessary payroll expenditures, while understaffing can lead to decreased service quality and potential loss of revenue.

The Impact:The consequences of these inefficiencies are multifaceted. Primarily, they result in higher payroll expenses, directly impacting the bottom line. Furthermore, manual processes and scheduling inconsistencies can lead to reduced employee productivity and morale. Employees burdened with repetitive tasks or facing the stress of understaffing may experience decreased job satisfaction and efficiency, potentially leading to higher turnover rates and further increasing labor costs.

The Solution: Addressing these issues requires a strategic approach focused on technology and operational optimization. Implementing POS systems with automated reporting and employee management features can significantly reduce manual labor. Automated reporting streamlines data analysis, while employee management features facilitate efficient scheduling and time tracking. Additionally, optimizing scheduling based on sales data and peak hours is crucial. By analyzing historical sales trends and identifying peak traffic periods, restaurant managers can create schedules that accurately match staffing levels to demand, minimizing both overstaffing and understaffing. This data-driven approach ensures efficient resource allocation and reduces unnecessary labor expenditures, ultimately contributing to improved profitability.

4. High Payment Processing Fees

Many businesses struggle with unexpectedly high payment processing fees, stemming from a combination of factors. These include hidden fees embedded within complex contracts, often lacking transparency and leading to unpredictable costs. Furthermore, unfavorable payment processing contracts can lock businesses into long-term agreements with inflated rates and limited negotiation power. A significant contributor to this problem is the lack of support for diverse payment methods. Restricting customers to traditional card payments can exclude a growing segment of consumers who prefer digital wallets, mobile payments, or other alternative options.

The Impact: The consequences of these issues are significant and directly impact a business’s bottom line. Reduced profit margins are a direct result of excessive fees, eating away at revenue. Moreover, limiting payment options can lead to customer dissatisfaction. Consumers expect flexibility and convenience; when their preferred payment method is unavailable, they may choose to patronize competitors who offer a more seamless experience.

The Solution: Businesses can mitigate these challenges by adopting proactive strategies. Firstly, comparing payment processing options and choosing transparent pricing is crucial. Scrutinizing contracts for hidden fees and selecting providers with clear, predictable pricing structures can significantly reduce costs. Secondly, businesses should ensure their POS system supports various payment methods, including digital wallets. Investing in a modern, versatile POS system allows businesses to cater to diverse customer preferences and stay competitive in an evolving payment landscape. This not only enhances customer satisfaction but also opens up opportunities to capture a wider market share. By implementing these solutions, businesses can optimize their payment processing, improve profitability, and enhance customer loyalty.

5. Data Entry Errors

Manual data entry, a seemingly ubiquitous practice across various business operations, presents a significant challenge due to its inherent time-consuming nature and susceptibility to human error. This is particularly prevalent in scenarios involving financial transactions, inventory management, and customer data recording. The process of manually transcribing information from physical documents or disparate systems into digital formats introduces numerous opportunities for inaccuracies, ranging from simple typos to misinterpretations of data.

The Impact: The consequences of inaccurate data entry can be far-reaching and detrimental to an organization. Incorrect data directly translates to flawed reports, leading to misguided strategic decisions and operational inefficiencies. In the realm of finance, such errors can result in significant financial discrepancies, impacting budgeting, forecasting, and profitability assessments. Furthermore, inaccurate data can expose businesses to compliance issues, particularly in regulated industries where precise record-keeping is mandatory. Data integrity is crucial for maintaining trust with stakeholders and adhering to legal requirements.

The Solution: To mitigate the risks associated with manual data entry, businesses must adopt strategies that prioritize automation and integration. A crucial step involves integrating Point of Sale (POS) systems with accounting software and other relevant business applications. This integration facilitates seamless data transfer, eliminating the need for manual transcription and reducing the likelihood of errors. Furthermore, automating repetitive tasks, such as generating reports or updating inventory records, minimizes human intervention and streamlines workflows. By embracing these technological solutions, organizations can significantly enhance data accuracy, improve operational efficiency, and safeguard against potential financial and compliance risks.

6. Lack of Sales Insights

A significant challenge faced by many restaurants is the inability to track sales trends and customer preferences with precision. This lack of visibility stems from inadequate or non-existent systems for capturing and analyzing sales data. Consequently, restaurants often operate in a data vacuum, making it difficult to discern which menu items are performing well, which customer segments are driving revenue, and how sales fluctuate over time. This deficiency leads to missed opportunities for targeted promotions and menu optimization. Without concrete data, restaurants rely on guesswork when designing marketing campaigns or adjusting their menu, resulting in inefficient resource allocation and potentially misaligned strategies.

The Impact: The repercussions of this data deficit are substantial. Foremost, it directly translates to reduced sales and revenue. Without understanding customer preferences, restaurants struggle to tailor their offerings to meet demand, leading to lost sales. Furthermore, ineffective marketing efforts become a common consequence. Promotions designed without data-driven insights may fail to resonate with the target audience, resulting in wasted marketing budgets and minimal returns. Overall, the absence of sales insights hampers the restaurant’s ability to adapt to market dynamics and capitalize on emerging trends, ultimately hindering its growth potential.

The Solution: To overcome this obstacle, restaurants must embrace a data-driven approach. The key lies in utilizing Point of Sale (POS) systems equipped with robust analytics and reporting tools. Modern POS systems can capture granular sales data, including item-level sales, customer demographics, and time-based trends. By leveraging these tools, restaurants can gain a comprehensive understanding of their sales performance and customer behavior. Furthermore, restaurants should actively leverage this data to optimize pricing, promotions, and product offerings. Analyzing sales data allows for informed decisions regarding menu adjustments, targeted promotions, and dynamic pricing strategies. This data-driven approach empowers restaurants to maximize revenue, enhance customer satisfaction, and achieve sustainable growth.

Transform your business today

We provide modern POS solutions that are designed to cut your losses and help your business grow! Furthermore, SMEs are eligible for up to 80% support for the adoption of EPOS Pre-Approved Solutions under the IMDA SMEs Go Digital programme. We also offer Digital Marketing Solutions for SMEs seeking business growth, providing tailored marketing strategies catered to the unique needs of each business. Last but not least, keep your customers returning with the EPOS Loyalty Program, powered by Whataspp! Contact us today to transform your restaurant with the right POS.

Was this article helpful?

YesNo