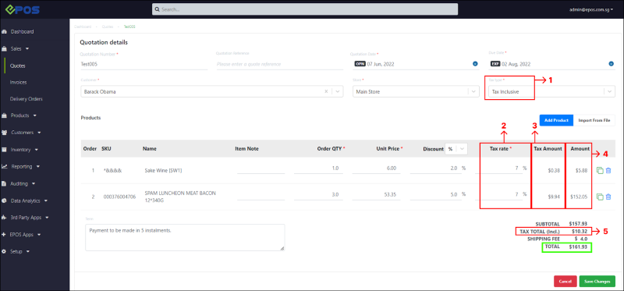

No | Fields/Functions | Description |

1 | Tax Type* | Select Tax Inclusive for the Tax Type. |

2 | Tax Rate* | Enter a suitable tax rate for each line item. 💡 By default, this field will display 7% for all line items. |

3 | Tax Amount | Display the total Tax amount for that line item. 💡This field is calculated by: [(Unit Price – Discount) / (100% + Tax rate %)] x Tax rate % x Order Qty |

4 | Amount | Display the sum total for the line item. 💡[For Tax Inclusive Quotations/Invoices] This field is calculated by: (Order Qty x Unit Price) – Discount |

5 | Tax Total | Display the total tax amount for all line items [For Tax Inclusive Quotations/Invoices] |

– | Total | Total : Display the quotation/invoice grand total 💡This field is calculated by: (Subtotal + Shipping Fee) |