No products in the cart.

Column A : product_handle (compulsory)

Product code, usually can be the same as SKU.

💡 Must not have duplicates.

💡 Product Handle field supports special characters – . _ ~ : / ? # [] @ ! $ & ‘ () * + =”

Column B : sku (compulsory)

Known as Stock Keeping Unit.

💡 Must not have duplicates.

💡 SKU field supports special characters – . _ ~ : / ? # [] @ ! $ & ‘ () * + =”

Column C : product_category

Product category, just enter the sub category name if available.

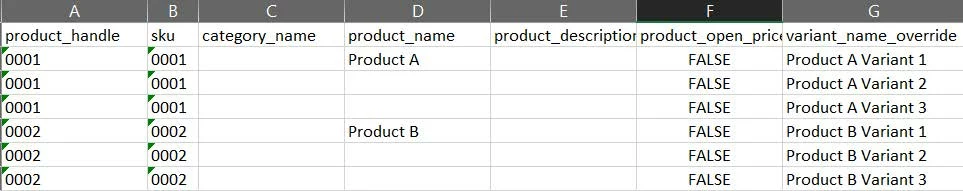

Column D : product_name (compulsory)

Enter the product name as concisely as possible, multiple languages are

accepted.

Column E : product_description

Enter the description for a particular product if needed.

Column F : product_open_price

Only “TRUE” or it can be left blank.

● “TRUE” to allow cashiers to enter prices manually at the POS.

● “FALSE” or left blank to disable open price setting at POS.

Column G : variant_name_override

To import variants of a product of the same type.

● Keep product_handle consistent for the variants of the product.

● product_name to only be filled for the first line of the same product. E.g.

Column H : variant_description_override

Enter the description for the product. (if any)

Column I : variant_base_price (compulsory)

Price for sale

Column J : barcode_raw

Enter product barcode manually or scan item barcode with a barcode scanner.

Column K : variant_supplier

Enter supplier name. (if any)

Column L : variant_supplier_code

Enter supplier code. (if any)

Column M : variant_cost_price

Enter price purchased from supplier.

Column N : attribute_1_name

Only applicable if importing product with variants

Column O : attribute_1_value

Only applicable if importing product with variants

Column P : attribute_2_name

Only applicable if importing product with variants

Column Q : attribute_2_value

Only applicable if importing product with variants

Column R : attribute_3_name

Only applicable if importing product with variants

Column S: attribute_3_value

Only applicable if importing product with variants

Column T : tax

Enter the tax type which was configured, if any. For more information, see Tax Rules.

💡 Tax Type must be created in backend portal before bulk importing

products (if applicable).

Column U : product_class

Enter one of the following. (as relevant)

● “COMPOSITE” for composite products. (e.g. a carton of coke = 12 cans.)

● “ADDON” for addon products. (e.g. additional toppings/servings which

are chargeable)

● “SETMENU” for products associated with a set menu.

● “SERIAL” for products with serial number

● “PACKAGE” for products to be setup as package

💡 To be left blank if not applicable, = normal product

Column V : is_weight_scale

Only enter TRUE or FALSE.

● “TRUE” for products which are priced by unit weight.

● “FALSE” or left blank to disable weight scale setting.

Column W : brand

Enter brand name. (if any)

💡 Only allow alphanumeric characters, chinese characters are not allowed.

Column X : track_inventory

Only enter TRUE or FALSE.

● “TRUE” as default, for inventory tracking.“FALSE” to hide products from inventory reporting.

💡 Leave blank = default as TRUE.

Column Y : serial_number

Compulsory field if “Serial” inserted at column U.

● “TRUE” – Product is tracked with serial number.

● “FALSE” – Product is tracked with IMEI.

💡 Can be left blank if product is IMEI tracked.

Column Z : imei_number

Compulsory field if “Serial” inserted at column U.

● “TRUE” – Product is tracked with IMEI.

● “FALSE” – Product is tracked with serial number.

💡 Can be left blank if product is Serial tracked.

Was this article helpful?

YesNo