No products in the cart.

The tax report will only be useful if a business is tax-registered. In order to set up the correct tax type, users should refer to Tax Rules for more information. The typical usage of a tax report is to allow users to have a quick overview of the total revenue and tax revenue generated from different types of taxes. From the backend portal, under Reporting, click on Tax Report.

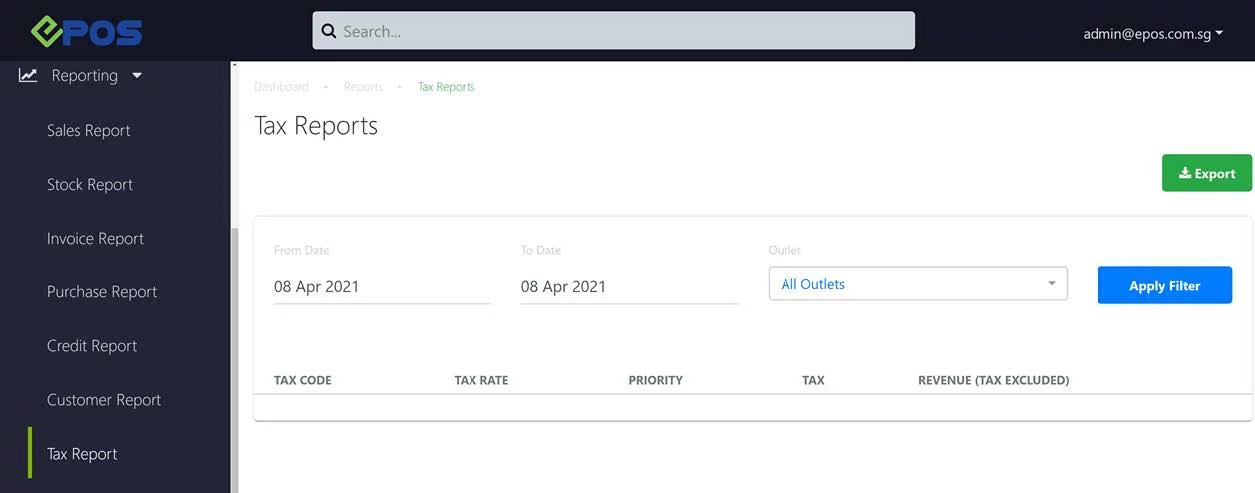

● Without tax setup

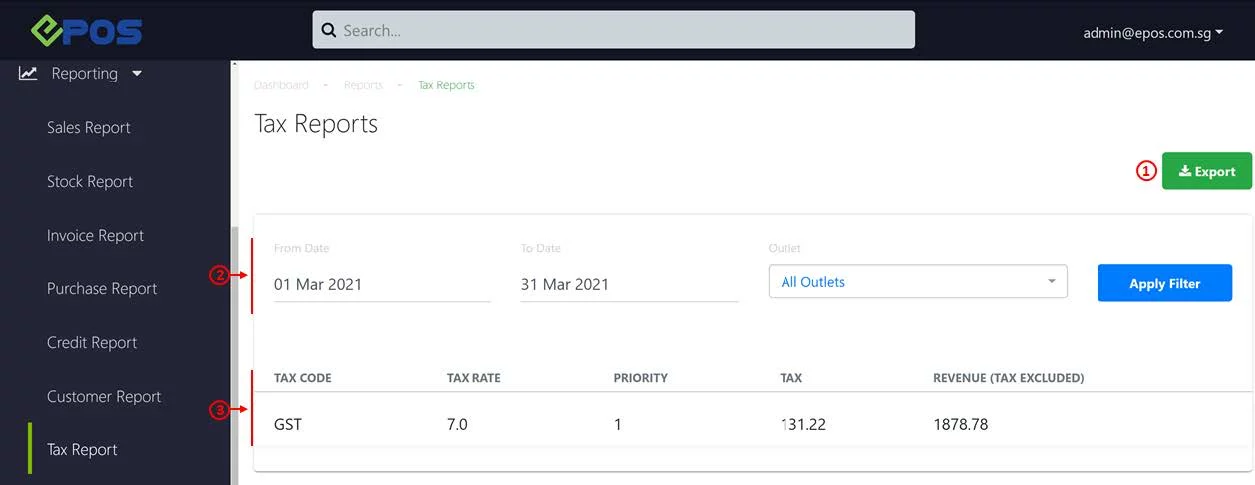

● With proper tax setup

1. Export

Allow users to export the Tax Report based on the filtered criteria.

💡 Users are advised to export the report for any further analysis of data generated.

2. Search and Filter

Allow users to generate a Tax Report based on specific date and outlet. Click on Apply Filter to generate a report.

3. Customer Report

Report generated will be based on the filtered criteria made in No.2.

Was this article helpful?

YesNo