No products in the cart.

PayNow has become an indispensable tool for businesses in Singapore, offering quick and convenient transactions. However, this popularity has also attracted scammers who are constantly devising new ways to exploit the system and target business owners. Stay vigilant and protect your hard-earned money by being aware of these common PayNow scams

In recent months, a concerning trend has emerged in Singapore, leaving retail owners and F&B stall owners counting their losses and grappling with a sense of betrayal. The convenience of PayNow, a widely adopted digital payment method, has been exploited by a growing number of individuals using fake or doctored transaction screenshots to deceive unsuspecting food and beverage (F&B) operators. This insidious scam not only results in immediate financial losses but also erodes trust and adds operational burdens on businesses already navigating a competitive landscape.

These recent cases highlight the importance of community awareness and the sharing of information to prevent more businesses from falling victim to these deceptive tactics.

1: The Fake Payment Screenshot Scam

Several cases have surfaced, painting a worrying picture of the scale and audacity of these scams. Restaurants across the island, from bustling hawker centers to established eateries, have fallen victim to this fraudulent tactic. The modus operandi often involves a customer showing a screenshot on their phone, seemingly confirming a successful PayNow transfer. Busy staff, especially during peak hours, may not have the immediate capacity to verify the transaction in real-time, leading them to believe the payment has been made. It is only later, upon checking their accounts, that the owners discover the funds never materialized.

One particularly recent case involved a hawker at who was scammed of $55.50 by a woman using a fake PayNow receipt. The hawker’s son, upon seeing reports of similar incidents, checked his father’s CCTV footage and bank records, uncovering the deception. In another instance, a seafood restaurant reported losses exceeding $4,600 over two years due to a customer repeatedly using fake PayNow screenshots. This highlights the potential for significant cumulative losses if such scams go undetected for extended periods.

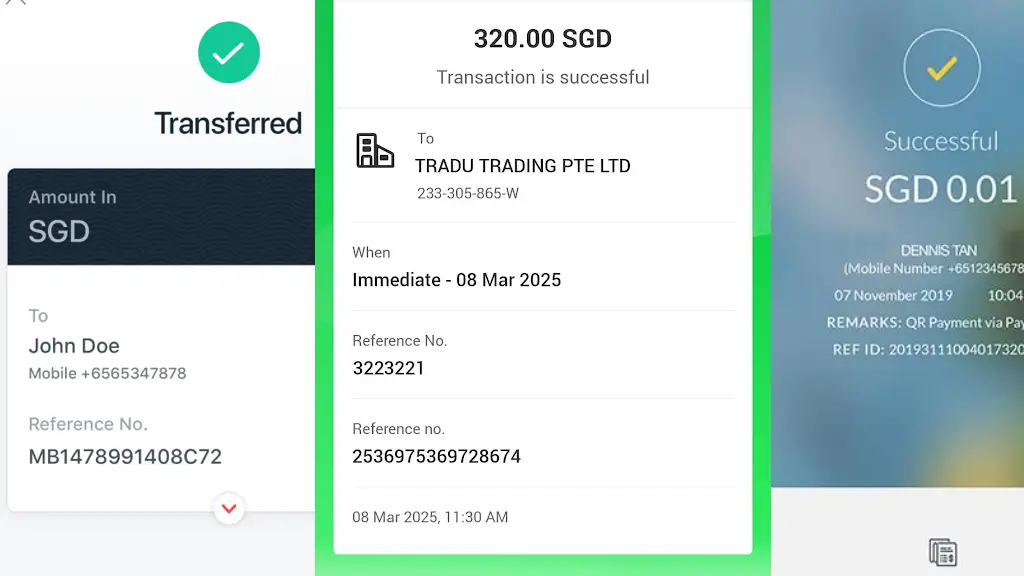

The sophistication of these fake screenshots can be alarming. In some instances, they appear genuine at first glance, making it difficult for staff to identify them as fraudulent, especially during busy service periods. Scammers may use photo editing tools to create convincing replicas of successful transaction notifications, complete with realistic details such as timestamps and transaction IDs.

It is very hard on your staff to differentiate between real and fake screenshots, especially when faced with with unfamiliar banking apps.

2: The Fake Supplier Scam

This scam often targets businesses that deal with procurement. Scammers impersonate staff from other organisations and place orders for equipment or accessories, requesting urgent delivery. They then provide contact details for a “supplier” and may even send fake payment confirmations for the initial order. When you contact the fake supplier, you’ll be asked to make full payment via PayNow, only to realize later that both the initial payment and the supplier are fraudulent. Always conduct thorough due diligence on new suppliers, and avoid making advance payments to unverified entities.

A recent case involved an owner of a food stall. The victim lost about $27,000 to a scammer who posed as a teacher making a reservation for nine tables. The scammers asked for specific brands and asked the stall owner to order it from their “supplier”.

3: The “Accidental Transfer” Refund Scam

You might receive a PayNow transfer from an unknown number, followed by a message claiming it was a mistake and requesting an immediate refund. Before processing any refund, carefully check your transaction history to ensure you actually received the funds and that the amount matches the claim. Scammers might try to pressure you into refunding more than you received or use this as a way to obtain your PayNow details for other fraudulent activities.

ACT against scams today

Beyond the immediate financial impact, these scams have broader implications for the F&B industry. They create an environment of distrust, forcing businesses to implement more stringent, and potentially time-consuming, payment verification processes. This can lead to longer wait times for customers and increased workload for staff.

The psychological impact on the victims is also significant. Small business owners and hawkers often operate on tight margins, and these unexpected losses can be deeply felt. The feeling of being cheated can be demoralising, especially for those who have built their businesses on trust and hard work.

While some victims have chosen not to pursue police reports due to the perceived hassle or small amounts involved in individual incidents, the cumulative effect of these scams can be substantial. Law enforcement agencies have issued advisories urging businesses to be vigilant and to implement stricter verification procedures for digital payments. These include:

Real-time verification: Always check bank accounts or PayNow transaction histories immediately to confirm receipt of funds before allowing the customer to leave.

Skepticism towards screenshots: While screenshots can be a form of confirmation, one should check the actual bank account for any fund movement.

Staff training: Equip staff with the knowledge to identify potential discrepancies or red flags such as static PayNow transaction confirmation screenshots.

Consider payment confirmation devices: Explore the use of dedicated devices that provide immediate audio or visual confirmation of successful PayNow transactions.

Get the EPOS Soundbox

Say goodbye to slow payment confirmations and the need for constant checks! Introducing EPOS Soundbox, the payment confirmation solution that audibly announces successful transactions, ensuring your staff never miss a beat.

The EPOS Soundbox streamlines your checkout process by providing clear, spoken confirmation of every successful payment. This innovative feature eliminates the need for staff to constantly monitor the screen, allowing them to focus on providing excellent customer service and increasing efficiency.

Key Features:

- Instant PayNow Payment Confirmation: A clear, customizable voice prompt announces “Payment Successful” upon completion of a transaction.

- Loud And Clear Voice Options: Easily adjust the volume to suit your environment.

- Free: 0.0% MDR With No Transaction Fees.

- Secure and Reliable: Built with the latest security protocols to ensure the safety of both customer and business data.

- Compact and Ergonomic Design: Sleek and space-saving design that fits seamlessly into any countertop.

- Dual Network Connectivity: Wi-Fi and 4G support for seamless operation.

Benefits for Your Business:

- Improved Staff Efficiency: Staff can focus on customer interaction instead of constantly checking the terminal screen.

- Reduced Errors: Eliminates the possibility of missed payment confirmations, leading to fewer discrepancies.

- Enhanced Customer Experience: Provides clear and immediate confirmation to customers, building trust and confidence.

- Faster Checkout Times: Streamlined process leads to quicker transaction completion.

- Increased Accessibility: Beneficial for staff with visual impairments.

- Modern and Professional Image: Showcases your commitment to innovation and customer convenience.

The EPOS Soundbox is the smart choice for businesses looking to enhance their payment process, improve staff productivity, and deliver a superior customer experience. Hear the difference today!

Contact us for a demo and discover how the EPOS Soundbox can streamline your business.

Was this article helpful?

YesNo